The Facts About Transaction Advisory Services Uncovered

The 9-Second Trick For Transaction Advisory Services

Table of ContentsThe 9-Minute Rule for Transaction Advisory ServicesThe Best Strategy To Use For Transaction Advisory ServicesHow Transaction Advisory Services can Save You Time, Stress, and Money.Transaction Advisory Services Can Be Fun For AnyoneWhat Does Transaction Advisory Services Mean?

This action sees to it the company looks its finest to possible purchasers. Getting business's value right is crucial for an effective sale. Advisors make use of different methods, like discounted cash money flow (DCF) evaluation, comparing with comparable firms, and recent deals, to find out the reasonable market price. This assists set a fair price and work out efficiently with future customers.Purchase consultants step in to help by obtaining all the needed info organized, answering questions from purchasers, and organizing sees to the service's place. Deal advisors utilize their knowledge to assist service proprietors take care of challenging arrangements, satisfy buyer expectations, and framework deals that match the owner's objectives.

Fulfilling legal rules is critical in any kind of company sale. Transaction consultatory services function with lawful professionals to develop and examine agreements, arrangements, and other legal papers. This lowers risks and sees to it the sale adheres to the legislation. The duty of transaction consultants expands beyond the sale. They aid company owner in planning for their next actions, whether it's retired life, beginning a brand-new endeavor, or managing their newfound riches.

Purchase advisors bring a wide range of experience and expertise, making certain that every facet of the sale is dealt with properly. Through calculated prep work, evaluation, and negotiation, TAS assists entrepreneur achieve the highest possible list price. By guaranteeing legal and governing conformity and managing due diligence together with other deal staff member, purchase experts minimize potential dangers and responsibilities.

Getting My Transaction Advisory Services To Work

By comparison, Big 4 TS teams: Deal with (e.g., when a prospective customer is conducting due diligence, or when an offer is closing and the buyer needs to incorporate the company and re-value the seller's Balance Sheet). Are with fees that are not linked to the bargain closing effectively. Earn charges per involvement someplace in the, which is less than what investment financial institutions earn also on "small deals" (however the collection probability is additionally a lot greater).

The meeting concerns are very comparable to investment financial meeting inquiries, however they'll concentrate extra on accountancy and appraisal and less on subjects like LBO modeling. For instance, anticipate questions concerning what the Modification in Working Resources methods, EBIT vs. EBITDA vs. Earnings, and "accountant just" subjects like test balances and exactly how to go through events making use of debits and credit ratings as opposed to monetary declaration modifications.

What Does Transaction Advisory Services Do?

Specialists in the TS/ FDD groups may likewise speak with monitoring about everything over, and they'll compose a comprehensive record with their findings use this link at the end of the procedure.

, and the basic shape looks like this: The entry-level duty, where you do a great deal of information and monetary evaluation (2 years for a promotion from here). The following level up; similar work, however you obtain the even more interesting little bits (3 years for a promo).

Particularly, it's tough to get promoted beyond the Supervisor degree since few people leave the task at that stage, and you need to start showing proof of your capacity to create earnings to breakthrough. Allow's start with the hours and way of living because those are less complicated to describe:. There are periodic late evenings and weekend break work, but nothing like the frenzied nature of investment financial.

There are cost-of-living modifications, so expect lower payment if you're in a less expensive place outside major monetary (Transaction Advisory Services). For all positions except Partner, the base salary comprises the mass of the complete settlement; the year-end reward may be a max of 30% of your base pay. Commonly, the most effective method to boost your incomes is to switch over to a look here various company and discuss for a higher income and benefit

Things about Transaction Advisory Services

At this stage, you should just remain and make a run for a Partner-level role. If you desire to leave, maybe relocate to a customer and do their appraisals and due persistance in-house.

The main problem is that because: You usually need to sign up with another Huge 4 team, such as audit, and work there for a few years and afterwards relocate into TS, work there for a couple of years and then move right into IB. And there's still no assurance of winning this IB role due to the fact that it depends upon your region, customers, and the working with market at the time.

Longer-term, there is also some threat of and because examining a company's historic monetary details is not specifically brain surgery. Yes, human beings will certainly constantly require to be included, however with advanced technology, reduced headcounts might potentially sustain client engagements. That claimed, the Deal Providers team defeats audit in terms of pay, job, and leave possibilities.

If you liked this post, you might be curious about reading.

Some Ideas on Transaction Advisory Services You Need To Know

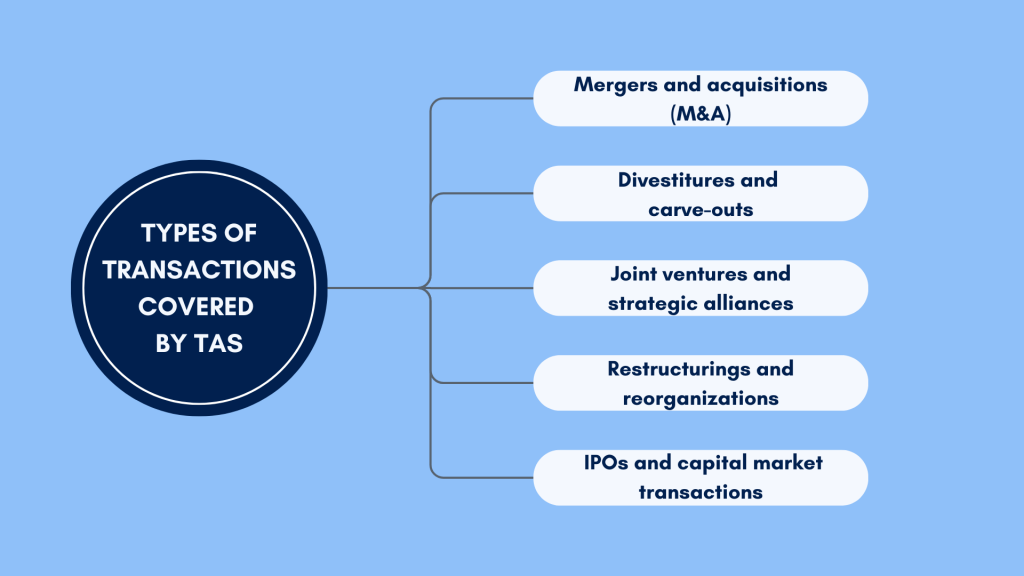

Establish important site advanced monetary structures that help in identifying the actual market worth of a firm. Give consultatory work in relationship to organization evaluation to assist in bargaining and rates structures. Explain one of the most suitable kind of the offer and the sort of consideration to use (money, supply, earn out, and others).

Create action strategies for danger and direct exposure that have been identified. Do integration planning to determine the procedure, system, and organizational changes that may be needed after the deal. Make mathematical quotes of integration prices and advantages to assess the financial rationale of combination. Set standards for integrating divisions, modern technologies, and service procedures.

Assess the possible consumer base, sector verticals, and sales cycle. The operational due diligence provides important insights into the performance of the firm to be acquired worrying threat analysis and worth production.